The commercial real estate sector is experiencing significant pressure to update its assets due to various challenges such as regulatory demands for environmental improvement and changes in work patterns. This includes the balance with home and office working, better use of existing spaces or even the reduced demand for space. Tenant expectations are rising, emphasizing the need for properties to promote wellness, flexibility, and collaboration. This necessitates strategic transformations through sustainable retrofits to reduce emissions and mitigate climate impacts, given the sector’s substantial contribution to global emissions.

In this article, we introduce our latest guide, which delves into the topic of Building Retrofitting. The guide explores subjects such as:

- The role of CRE in climate change mitigation

- Shifts in the CRE operating environment

- Incentives for retrofitting

- Enhancing workplace experiences through retrofitting

And much more.

The Sustainable Retrofit Imperative

In the urgent battle against climate change, global commitments to achieving net-zero emissions are crucial to prevent critical tipping points in the Earth’s climate system.

The Intergovernmental Panel on Climate Change (IPCC) has issued warnings that without immediate and significant reductions in greenhouse gas emissions, the goal of limiting global warming to close to 1.5°C may become unattainable.

It comes as no surprise that the building sector emerges as a substantial contributor to global CO2 emissions, particularly evident in many developed cities where old, inefficient buildings dominate the landscape.

Buildings and Climate Change

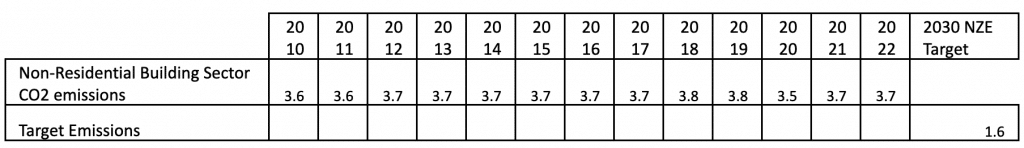

With buildings having long life cycles and a major impact on global warming, the real estate sector’s involvement is crucial in reaching Net Zero greenhouse gas emissions by mid-century. However, recent UN research suggests the sector is significantly behind in meeting its decarbonization targets. In fact, buildings and construction saw a 5% rise in emissions from 2020 to 2021, surpassing pre-pandemic levels by 2%.

To achieve the Paris Agreement’s climate goals, the building sector must rapidly decarbonize. Currently, two-thirds of global buildings are expected to still be in use by 2040, emitting CO2 unless they’re renovated.

Net Zero requires increased energy efficiency, renewable energy use, and eliminating fossil fuels. By 2030, all new construction and 20% of existing buildings must be Zero Carbon. This demands a fivefold increase in energy efficiency over the next decade, with a 45% reduction in energy consumption per square meter by 2030 compared to 2020. Retrofitting rates are too slow, with the focus mainly on new sustainable buildings. The IEA urges the sector to accelerate retrofitting to at least 3% of the building stock annually to meet Paris Agreement objectives.

Role of CRE in Climate Change Mitigation

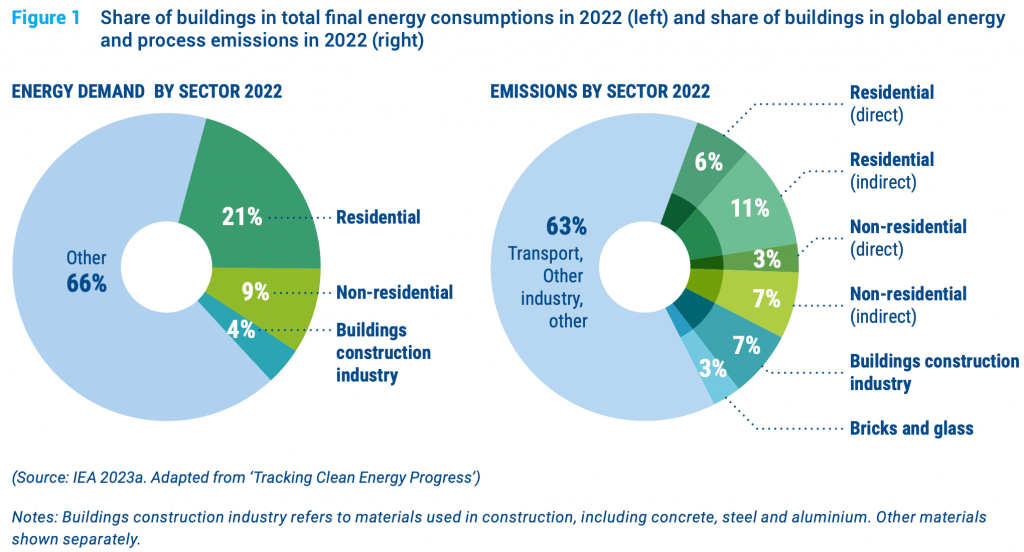

According to recent data from the UN’s Environment Programme, the buildings sector accounts for a staggering 37% of energy and process-related CO2 emissions globally, with over 34% of global energy demand attributed to it. In urban areas, the impact is even more pronounced, with buildings responsible for up to 60% of overall carbon emissions. Moreover, projections by the World Green Building Council suggest that the global building stock will double in size by 2050, further straining the world’s “carbon budget” as carbon emissions from built assets before utilization are expected to contribute significantly to the overall carbon footprint of new construction.

While a significant portion of emissions from buildings stems from the construction process of new buildings, building operations alone currently account for 26% of global energy-related emissions. Given this substantial impact, urgent efforts to decarbonize existing real estate assets and portfolios currently in use must be prioritized. Addressing inefficiencies in building operations is essential to curb the sector’s significant contribution to greenhouse gas emissions and align with global climate mitigation objectives.

Why Retrofit Rather Than Rebuild?

Retrofitting existing buildings emerges as a vital strategy to meet global climate targets set forth in agreements like the Paris Climate Agreement. While new construction is significant, its ability to swiftly achieve the necessary emissions reductions is hindered by slow turnover rates. Retrofitting, on the other hand, offers a practical and carbon-efficient route to reaching these objectives. By preserving and enhancing existing structures, the massive upfront carbon costs associated with new construction are avoided, aligning with the imperative to reduce embodied carbon emissions from materials like aluminum, steel, and concrete.

An example case, such as the redevelopment of “The Kensington Building” by AshbyCapital, demonstrates the potential of retrofitting. By repurposing much of the existing structure, it achieved a noteworthy 35% reduction in embodied carbon compared to a typical new-build office.

Investments in energy-efficient enhancements like insulation, HVAC systems, smart lighting, and renewable power generation can yield substantial reductions in both energy-related costs and day-to-day operational emissions in commercial buildings.

Moreover, retrofitting remains the most cost-effective strategy for most buildings, allowing property owners to make incremental improvements without the extensive costs associated with demolition and new construction. This approach offers several advantages, including reduced demand for new materials, less intensive labor requirements, and the ability to maintain occupancy and rental income during the retrofit process. Furthermore, retrofit projects can be completed in shorter timeframes, minimizing disruption to tenants and ensuring continuous operation, thereby enabling building owners to adapt to market demands and enhance property value effectively.

Barriers to Progress:

The commercial real estate (CRE) sector’s slow progress in sustainability efforts stems from various factors:

- Market Conditions: economic challenges like high inflation, rising interest rates, and supply chain disruptions prioritize immediate financial needs over long-term sustainability investments.

- Upfront Costs: sustainable retrofits require substantial initial investment, hindering adoption, despite potential long-term savings on energy bills.

- Retrofit Process Complexity: retrofitting existing buildings is complex and disruptive, requiring careful planning, multidisciplinary collaboration, and consideration of technology compatibility and longevity.

- Lack of Awareness and Expertise: many property owners lack awareness of sustainability benefits and expertise in implementing sustainable practices effectively.

- Split Incentives: In leased properties, owners bear improvement costs while tenants enjoy benefits, discouraging owners from investing in sustainability.

- Regulatory Complexity and Inconsistency: inconsistent regulations and lack of financial incentives hinder uniform adoption of sustainable practices across regions.

- Lack of Quantifiable Benefits or Metrics: challenges in measuring and reporting sustainability metrics make it difficult to demonstrate the benefits of sustainability initiatives.

- Slow Adoption of Technology: skepticism, lack of awareness, and resistance to change delay the adoption of new technologies in the CRE sector.

Alternatives to Retrofit

With a notable portion of existing commercial real estate (CRE) assets facing potential obsolescence in the next five years, landlords and developers have several alternatives to retrofitting available to them:

- Repurposing: this involves transforming properties into mixed-use spaces, industrial facilities, life sciences hubs, or healthcare centers, adapting to evolving market demands. However, challenges arise in assessing demand and managing economic and environmental complexities. While repurposing activity is anticipated to increase, feasible opportunities for office conversion remain limited, and many properties are unsuitable due to design constraints.

- Conversion: this approach entails repurposing low-quality commercial spaces into residential housing or converting offices into warehousing for e-commerce. Residential conversion is often cost-effective and eco-friendly, addressing urban housing shortages, but may encounter obstacles such as cost and regulations. Warehousing conversion meets e-commerce demands but brings adverse environmental impacts and community resistance.

- Redevelopment: this involves demolishing and rebuilding a site, offering significant transformation and potential property value increases. Redevelopment may be preferred when retrofit costs are deemed excessive or safety concerns make retrofitting impractical. However, it may face opposition from local authorities due to carbon emissions and environmental concerns.

Each alternative presents unique advantages and challenges, requiring careful evaluation of market demand, environmental impact, and regulatory compliance. A life cycle assessment approach is essential to balance embodied and operational carbon trade-offs, considering the environmental impact of materials and operations throughout their life cycle. This holistic approach is crucial for understanding the sustainability of retrofitting compared to new constructions, aiding in decision-making for transforming underutilized CRE spaces.

All Stakeholders Have a Role to Play on CRE Carbon Emissions

Stakeholders, including policymakers, building owners, and investors, must address the challenge of making existing buildings sustainable for a low-carbon future. Many stakeholders need further education on sustainability benefits and staying informed about evolving standards. Overcoming retrofit challenges requires collaboration among stakeholders:

- Policy makers can influence sustainability through legislation, offering incentives and penalties. Governments can support retrofitting in public buildings and fund research in sustainable technologies.

- Property owners can initiate retrofit projects, considering financial viability and marketability. They can tailor projects to maximize environmental and financial performance.

- Financial institutions can de-risk investments by offering favorable financing options and incentives, signaling a shift towards valuing sustainability.

- Industry associations can foster collaboration, set standards, and educate the market on sustainability’s long-term value.

In short, the CRE sector stands at a critical juncture where adaptation to sustainability is no longer optional but a strategic necessity for long-term value preservation and market competitiveness. CRE stakeholders must strategically decide between new construction, retrofitting existing buildings, or reshaping their portfolios. Sustainable retrofits, fueled by innovation and strategic foresight, offer a compelling path to attracting new tenants, enhancing rental returns, and optimizing space utilization based on data-driven insights.

.