The CRE landscape has shifted, making investments more challenging. With changing work dynamics and declining demand for office space, many properties risk becoming obsolete. This transformation has led to intense competition, creating a buyer’s market and favoring high-quality spaces.

Developers face tough decisions amid uncertainties, including shifts in demand and macroeconomic factors like inflation and labor shortages, making the outlook for 2024 unclear. Let’s delve deeper into this landscape.

A Challenging CRE Operating Environment Shifts the Incentives Towards Retrofit

Hybrid Work’s Impact on Space Demand

Tenant priorities and space demand shifted before COVID-19, spurred by trends like coworking spaces and flexible leases. The pandemic accelerated this shift, pushing remote work globally. Even as COVID-19 threats diminish, studies show a preference for hybrid work.

A 2023 Deloitte survey found that 56% of employed adults work from home at least some of the time, with 22% working fully from home and 34% on a hybrid schedule. On average, hybrid workers spend 3 days in the office and 2.6 days working at home. While 83% of workers in an Accenture survey have expressed a preference for a hybrid work model in the future.

While some US companies mandate full-time onsite work, there’s a rising trend towards employee choice models, especially among public and Fortune 500 firms. The Asia Pacific Occupier Survey shows that in Europe and the U.S., most employers prefer hybrid work. This preference is also seen among Asia-Pacific companies, though to a lesser extent.

Office occupancy varies globally but remains below pre-pandemic levels, prompting reevaluation of space use. Despite return-to-office mandates, vacancy rates are high worldwide, reaching a record 15.9% in Q3 2023, with North America seeing the largest increase where vacancy increased by 39 basis points quarter over quarter to 21.0%. Followed by Europe and Asia Pacific.

While reduced demand poses financial challenges, it also presents opportunities for sustainable redevelopment, aligning CRE assets with climate goals and urban development practices. Forward-thinking owners can use this transition period to undertake sustainable retrofit projects, enhancing environmental performance and long-term value.

Impacts on Leasing Volumes & Rental Returns

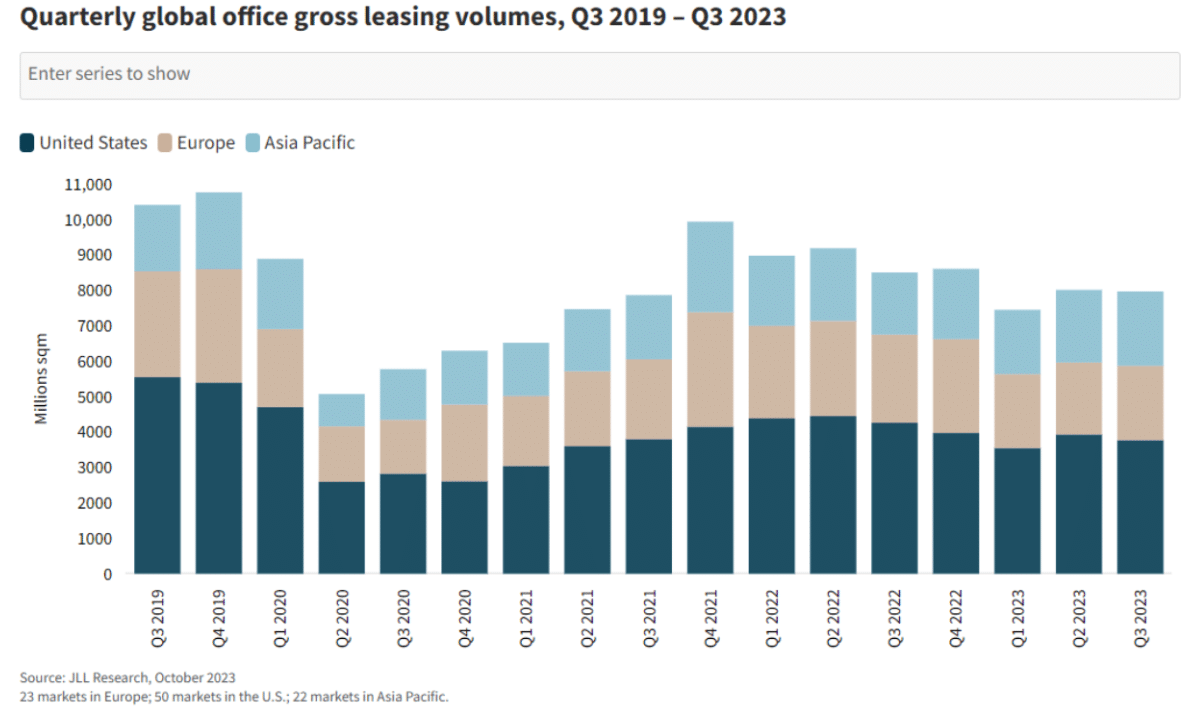

Space demand trends are influencing leasing demand as pre-COVID leases reach renewal. Despite a rapid recovery in global office leasing volumes between Q2 2020 and Q4 2021, the rebound has proven short-lived. As of Q3 2023, leasing volumes were 6% lower than the previous year and 24% below pre-pandemic third-quarter averages.

Source: Signs of gradual recovery in demand

Landlords hoped for a return to pre-pandemic leasing levels, but signs of recovery are scarce, especially with a looming recession. The Financial Times estimated that by February 2023, only a third of office leases set to expire between 2020 and 2030 had done so. The inherent “lag in the system” masked the reality of these longer-term effects for a while, as longer-term leases locked in tenants to deals signed before COVID-19 emerged.

In March 2023, Cushman & Wakefield forecasted ongoing office vacancy increases in the US, with rates expected to remain high until 2030, surpassing the healthy vacancy threshold of 13%. They predict the US market alone will have 1.1 billion square feet of vacant office space by the decade’s end, a 55% increase from pre-pandemic levels. About 330 million square feet of office space is projected to become redundant by 2030, roughly equivalent to the entire office inventory of the Washington metropolitan area.

Across Europe, Cushman and Wakefield’s analysis warns that office markets face a critical risk. Without intervention, a substantial portion (76%) of office stock could become obsolete by the decade’s end. Repositioning these assets is seen as both an opportunity and a necessity to address this looming challenge.

In July 2022, the Investors Chronicle cited economist Stijn Van Nieuwerburgh’s analysis, revealing that 73% of office leases in New York and 66% in the US had not yet been renewed since the pandemic began. This indicates that the long-term effects are still unfolding, contributing to persistently high vacancy rates that negatively impact real estate firms. JP Morgan warns that even minor changes in vacancy rates can significantly reduce rental returns, with a historical analysis showing a 2-3% decline in rental revenues for every point change in US markets.

Additionally, some tenants, like KPMG, are adapting to new work models, as evidenced by their 20-year agreement to move to Two Manhattan West in August 2022. KPMG’s adoption of a hybrid work model led them to leave three older buildings and reduce their lease space by 40%.

Regulatory Pressure

Growing pressure from regulations and stakeholders is prompting the commercial real estate market to embrace sustainability and efficiency.

As emissions regulations become stricter, compliance is becoming a strategic priority for CRE. Many countries and cities are introducing energy efficiency laws for buildings. The EU Building Directives, including the Energy Performance of Buildings Directive (EPBD), mandate high energy efficiency standards for new and renovated buildings. Non-compliant buildings face renting or selling restrictions, incentivizing owners to invest in sustainable upgrades. These directives align with broader EU goals for environmental sustainability.

The UK Government has committed to the country becoming net zero by 2050 alongside Wales who have made the same commitment; in Scotland, an earlier deadline of 2045 has been set. Cities are setting ambitious targets, with a Net Zero Carbon Buildings Standard being developed.

New York’s Local Law 97 mandates that buildings over 25,000 square feet must meet stringent emissions caps, with penalties for non-compliance. Similarly, the UK has implemented the Minimum Energy Efficiency Standard (MEES), requiring buildings to achieve a minimum Energy Performance Certificate (EPC) standard of E from 2023. Properties failing to meet this standard must undergo retrofitting before they can be leased or sold. Government consultations suggest that MEES requirements could escalate to a B-grade standard by 2030 through a series of firm deadlines.

Regulations are tightening globally, driven by net-zero commitments. Policies like Local Law 97 and EU directives signal ongoing regulatory tightening. CRE stakeholders should not only prepare to meet current regulations but also anticipate and adapt to more demanding environmental criteria in order to position themselves at the forefront future market developments.

Corporate Commitments to ESG+R

Global public companies are increasingly making climate commitments, with sustainability reporting among the world’s top 250 firms reaching 96% according to KPMG’s 2022 analysis. However, the built environment lags behind, as highlighted by the World Benchmarking Alliance (WBA) and CDP. Their assessment reveals that 54% of companies have yet to develop a climate transition plan, and 44% have not set any targets to reduce emissions.

A recent Deloitte survey showed that 63% of global C-level business leaders are deeply concerned about climate change, viewing the world as at a tipping point. Nearly all respondents (97%) noted negative impacts on their companies, with about half reporting disruptions to business models and supply networks. Deloitte’s analysis highlights additional pressure from stakeholders such as regulators, shareholders, consumers, and employees to take action.

The COVID-19 pandemic and climate change-induced natural disasters have heightened focus on resilience planning. This has led to the integration of resilience considerations into ESG frameworks, with calls for a formal addition of “R” for resilience.

The heightened focus on ESG+R is driven by intensifying climate change risks and rising expectations from investors, shareholders, tenants, and the public. Investors seek assets with minimized exposure to transition risks and physical risks from extreme weather. ESG credentials are increasingly influencing tenant and investor preferences when it comes to property selection. Healthier spaces, characterized by more natural light, greenery, optimized ventilation, and air quality, have been shown to boost employee health, satisfaction, and productivity, while also serving as a strong indicator of corporate responsibility. Strong governance and emergency preparedness also mitigate business disruption from climate and health crises.

To attract financing, companies must show resilient assets and credible strategies for achieving net zero emissions by 2050. Failing to integrate ESG+R into their strategy risks destroying long-term value. Proactive measures to enhance asset resilience and reduce emissions offer competitive advantages, attracting tenants and investors.

Providing Competitive Advantage & Value Enhancement

We are witnessing a “Flight to Quality,” in the CRE sector. As companies review their portfolios, and re-evaluate their space demands, prevailing market trends mean they are often spoilt for choice when searching for new properties. This is increasingly shaping the way landlords adapt their business strategies and leasing management practices, with a focus on catering to the evolving needs of tenants.

The divergence between prime and secondary office buildings is becoming more pronounced in the global CRE market’s slow and uneven recovery post-pandemic. Forward-thinking owners are proactively future-proofing their properties by investing in net zero carbon initiatives, upgraded amenities, and digital connectivity. These investments provide a competitive edge, enhance returns, encourage employees to return to the office, and aid in talent attraction and retention. Early adopters of sustainable retrofits can enjoy higher rents, reduced financial risk, improved access to capital, and favorable rates, staying ahead in a competitive market.

With regulatory pressures rising and corporations placing a greater emphasis on sustainability, evidence suggests that investing in sustainability initiatives can yield tangible financial returns. Studies indicate tenants are willing to pay a “green premium” for sustainable buildings, which are in higher demand and command higher sales and rental premiums.

An MIT study revealed that tenants and buyers are willing to pay an 8.2% premium in rent and a 23.7% premium for smart buildings offering personalized occupant experiences. Dr. Chegut, the lead author, noted that buildings combining intelligence, connectivity, and sustainability extract the greatest value, with smart, connected, and green buildings commanding higher rents and sales prices.

Sustainability’s value becomes notably pronounced when demand for eco-friendly spaces surpasses supply. In Hong Kong, where high-quality, green-certified office spaces are scarce, rental premiums reach 28% for LEED Platinum certified buildings, as less than one-third of Grade A stock is green-certified. Conversely, in Singapore, where 90% of Grade A offices are green, premiums range from 4% to 9%.

Green and wellbeing certifications such as LEED, BREEAM or WELL help to provide tangible metrics and frameworks for companies to measure and demonstrate their environmental and well-being credentials beyond the directly linked efficiency savings and cost reduction. Conversely, properties that lack such upgrades risk becoming obsolete.

Offices located in thriving city centers should fare well, but older buildings with outdated amenities will increasingly struggle to attract tenants, leading to a glut of obsolete vacant space that will inflate overall vacancy rates in many cities. The decline of suburban offices is highlighted by recent PWC analysis, which ranks “suburban office” in last position for investment prospects and second last for rental prospects in 2023.

Remember, you have access to our comprehensive free Guide on Sustainable Retrofits for deeper insights, data, and inputs. Feel free to reach out if you have any questions or want to explore the topic further, or if you’re considering enhancing your workplace. We’re here to help!